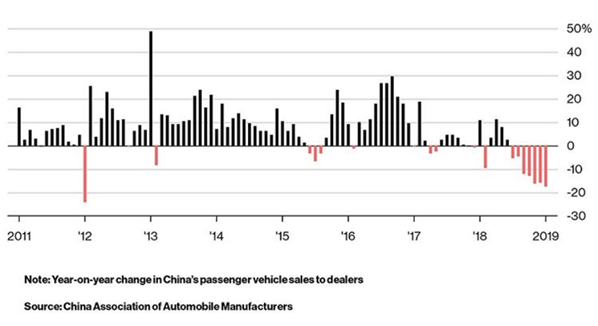

- Auto sales are down in China due to a slowing economy and US trade war

- In major developed markets such as Europe and North America, competitive threats from ride-sharing services have lowered the need for owning a vehicle

- Investors of General Motors, Tesla and Ford should be wary

The number of cars sold in China has fallen again, after the first annual slump in more than two decades. January’s drop of 17.7% in vehicle wholesales (below) was accompanied by an eighth consecutive monthly decline in retail sales.

Automakers are facing headwinds in all major markets. Chinese sales are down as the world’s second-largest economy slows and the trade war with the US drags.

The markets in Europe and North America are also shrinking as the increasing availability of ride-hailing and car-sharing services like Uber and Lyft makes it less necessary to own a vehicle.

These threats pose a problem for automakers already relying on razor thin profit margins. General Motors (NYSE:GM), Tesla (NASDAQ:TSLA) and Ford (NYSE:F) are all reporting profit margins lower than 5%.

Article by: Mick Ross

Mick is currently a full-time investor and formerly a buy-side analyst (2yrs) covering healthcare companies. Before that, he was a salesperson at a bulge-bracket firm, based in Dallas, Texas. Mick blogs to clarify and synthesize his investment thought process and to elicit feedback; additionally he likes to connect with other investors and swap ideas.