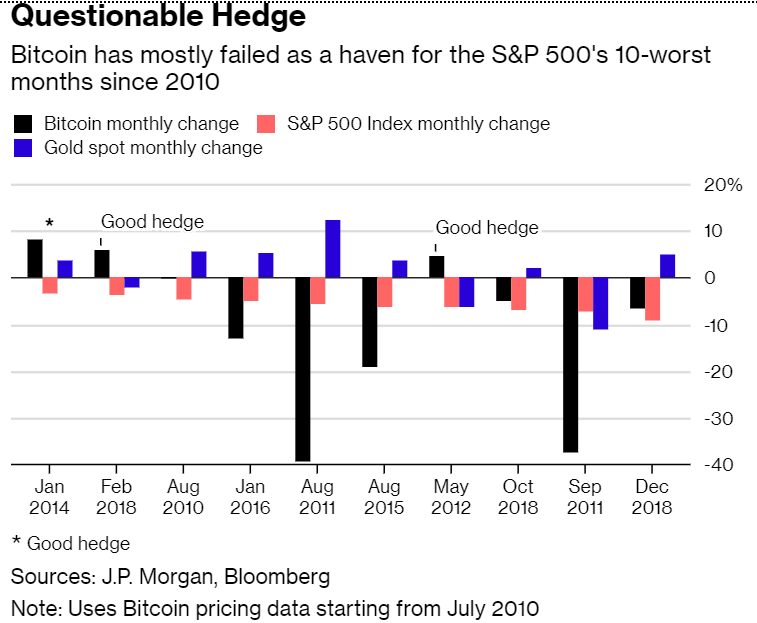

- Data from JP Morgan is indicating that in next bear market, gold is the better safe haven asset than Bitcoin.

The price of Bitcoin has fallen to just over $3400. It’s been a disappointing start to the year for crypto investors, who hoped that the pain of the downturn was behind them. More than $400 billion in market value was wiped out in the past 12 months as widespread adoption failed to materialize, according to data from CoinMarketCap.com. The total market capitalization is now about $113 billion.

One of the most common investment arguments for Bitcoin — that it’s a superior hedge to markets and other traditional hedges such as gold — doesn’t actually hold up that well, according to JPMorgan.

Bitcoin has yielded a positive return in only 3 of the worst 10 S&P monthly performances since earliest available Bitcoin data (July 2010). Gold, on the other hand, has had 7 positive months in the worst 10 S&P monthly performances.

So in next bear market, instead of looking at BTC, data shows that gold is the better safe haven asset.

Article By: Fatimah Aminu

Fatimah is an experienced editor at various financial and consumer publishing houses. She obtained a master’s degree in Publishing from NYU, where she earned a bachelor of fine arts degree. She is currently earning a second masters degree at CUNY online in Psychology. Fatimah covers healthcare, cannabis and technology.