- DJI up >5% to YTD in 2019; followed by China, EU and UK.

- Financial services, e-commerce and telecommunications companies are buoying stocks globally

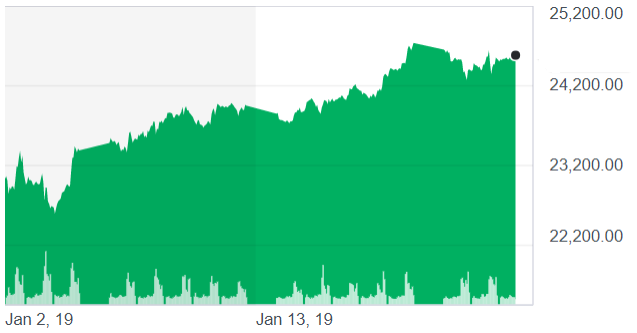

In 2018, the Dow fell 5.6%. The S&P 500 was down 6.2% and the Nasdaq fell 4%, marking the worst market performance since 2008.

December 2018 was particularly dreadful for US markets – the S&P 500 posted a 9% loss, the worst since 1931.

23 days into January the Dow Jones Industrial Average or ‘DJIA’ is at 24,575.62, up 5.2% from an open at 23,346.24 to mark the start of 2019.

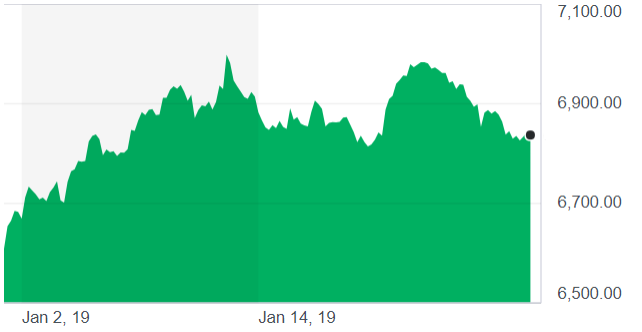

Across the pond, Brexit uncertainties have weighed on the UK’s 100 largest listed names, with the FTSE 100 up just 1.61% to 6,842.88 as of the close on January 23, 2019.

In China, 2018 was a dreadful year for the markets. The Shanghai Stock Exchange Composite Index, a stock market index of all stocks that are traded at the Shanghai Stock Exchange, lost close to a quarter of its value in 2018, but is up 4.69% year-to-date in 2019.

Globally, financials, technology, e-commerce and telecommunication names are buoying year-to-date gains for global stocks.

Article by: Francisco Cortez – Delgado

I graduated from Queen’s University with a Master’s of Political Studies. The intertwined world of politics and economics intrigue me. My favourite stories to cover are the ones that show how a few selected officials can impact nationwide macro-economic policies. I also follow the broader markets and FOREX.