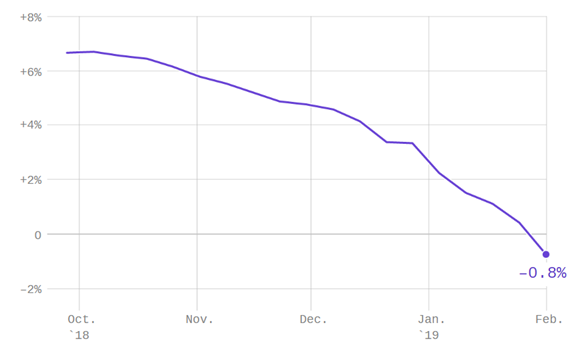

Wall St analysts expect the S&P 500 to post 0.8% earnings decline in Q1 2019, over the same period in 2018. These expectations have fallen monthly since October 2018, mainly due to factors such as expected global economic slowdown and an ongoing trade war between US/China.

As recently as Sept. 30, analysts predicted the earnings growth rate for the current quarter would hit 6.7%. If their estimates prove to be true, it would be the first year-over-year contraction of S&P earnings since the second quarter of 2016.

A decline in earnings would increase the risk that global markets may face a tough 2019. Thus far, investors have already cooled on companies that have given weak guidance, including Apple (AAPL) and Caterpillar (CAT).

Article by: Mick Ross

Mick is currently a full-time investor and formerly a buy-side analyst (2yrs) covering healthcare companies. Before that, he was a salesperson at a bulge-bracket firm, based in Dallas, Texas. Mick blogs to clarify and synthesize his investment thought process and to elicit feedback; additionally he likes to connect with other investors and swap idea